The stock market made a significant comeback in 2023, gaining 24%. But with the positive market sentiment, many stocks gained much more than that. Nu Holdings (NYSE: NU), which is part of the Berkshire Hathaway equity portfolio, gained 105% last year. Can it do a repeat in 2024?

Why Nu outperformed last year

Nu has many features that appeal to both clients and investors. It's an all-digital bank that provides a suite of low-fee financial services to its customers in Brazil, Mexico, and Colombia. The concept is catching on, and Nu is recruiting customers at a rapid pace. It added 5.4 million customers in the 2023 third quarter, and it now has more than half of the adult population in Brazil on its platform. Lest you think that amounts to saturation, it added as many as 1.5 million customers monthly in Brazil in the quarter, and it has a healthy base from which to onboard more. It has expanded into regions where it still has low penetration -- only 3% in Mexico and 2% in Colombia as of early 2023, so the market is still wide open. It will probably enter other regions in the future.

On top of that, it's been successful with its strategy of cross-selling and upselling new products to existing customers. It measures that with average revenue per active customer (ARPAC), which increased 18% over last year in the third quarter to $10.

Why it could double again

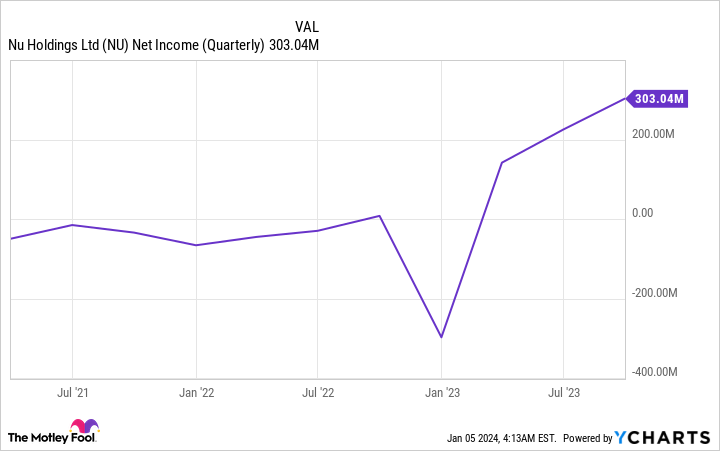

Nu was a typical unprofitable growth stock for a while, but as it has scaled, it has delivered two consecutive quarters of net profit, and both represented increases.

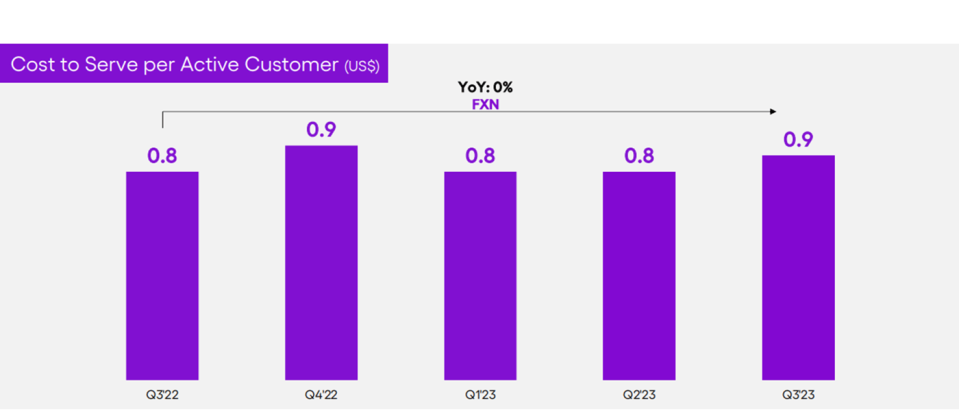

Its cost to serve has remained relatively stable. Management says that underscores its operating leverage, and Nu is turning into a superstar fintech company that combines high-tech digital solutions with the cash-generation abilities of a traditional bank. That creates high growth along with stability and long-term viability.

It had an incredible 2023 despite rising inflation and high interest rates, macro forces that typically hurt banks. Even its credit business, which would be the most vulnerable part of the business, demonstrated solid performance. Deposits increased 26% over last year in the third quarter, and that's not surprising because consumers are fishing around for better rates in this climate. But loans were up as well, and net interest margin was at an all-time high of 18.8% in the third quarter. That reflects excellent operational management.

Inflation is moderating in the U.S. and Brazil, and the Federal Reserve said it might cut interest rates this year. Other countries are likely to follow suit, and lower interest rates should lead to even better performance for Nu.

Don't miss Nu stock as it climbs higher

Can Nu stock double again this year? Absolutely. Its business is thriving, and conditions should work more in its favor in 2024.

At the current price, Nu stock trades at a forward price-to-earnings ratio of 25, which looks reasonable given the company's performance and opportunities. If it continues to report the kind of growth and rising profitability that it did in 2023, you should expect the stock to rise still more. It might even do better this year than last year.

Should you invest $1,000 in Nu right now?

Before you buy stock in Nu, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Nu wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Jennifer Saibil has positions in Nu. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Nu. The Motley Fool has a disclosure policy.

Nu Stock Doubled in 2023. Can It Do It Again in 2024? was originally published by The Motley Fool

"do it" - Google News

January 08, 2024 at 05:45PM

https://ift.tt/3R2WxET

Nu Stock Doubled in 2023. Can It Do It Again in 2024? - Yahoo Finance

"do it" - Google News

https://ift.tt/pbXBCeN

https://ift.tt/qFNHpZx

Bagikan Berita Ini

0 Response to "Nu Stock Doubled in 2023. Can It Do It Again in 2024? - Yahoo Finance"

Post a Comment